Welcome to the first of what I hope will be many articles exploring the wild and exciting world of NFTs, GameFi, and the metaverse. While the industry is going through a rough patch that can be deemed as the “through of disillusionment” and repeatedly gets harshly slaughtered by the media and by ‘normies’ alike, digital assets and the frameworks around them are an area I have deep conviction in. I believe they will serve as the core technologies that will bring about the next major wave of innovation on the internet.

For the first post, I thought it might be useful sharing my personal experiences witnessing the rocky ups and downs of digital collectibles and how they came to be actual assets with which people formed emotional as well as financial attachments. This is not meant to be an exhaustive history but rather an attempt to capture the essence and evolution of the space long long before NFTs ever came into existence…and ultimately saved the day.

Physical Collectibles – Relics From the Past

Ever since I was a kid I’ve been an avid collector.

In one way or another, it started with stamps: their art was simply glorious and back then in the early 90s just that alone was enough to keep a young kids’ attention. It didn’t take long thought before something ‘shinier’ came along and for my brother and I that was these cards called Top Trumps, specifically the car variety. We proceeded to get every single one we laid our eyes upon (seriously, we degened into the tractor collection at one point) until one day on a random trip we lost the whole giant pile.

The 1994 World Cup Panini book and stickers was a big gateway to this addicting hobby for many in my generation. My mother still reminds me about how I spent my final hours at school, before moving permanently abroad, hustling in the school courtyard trying to flip my extras for those final few elusive Brazilian players to complete my collection. I’m still convinced to this day that their drop rates were predatorily nerfed compared to others!

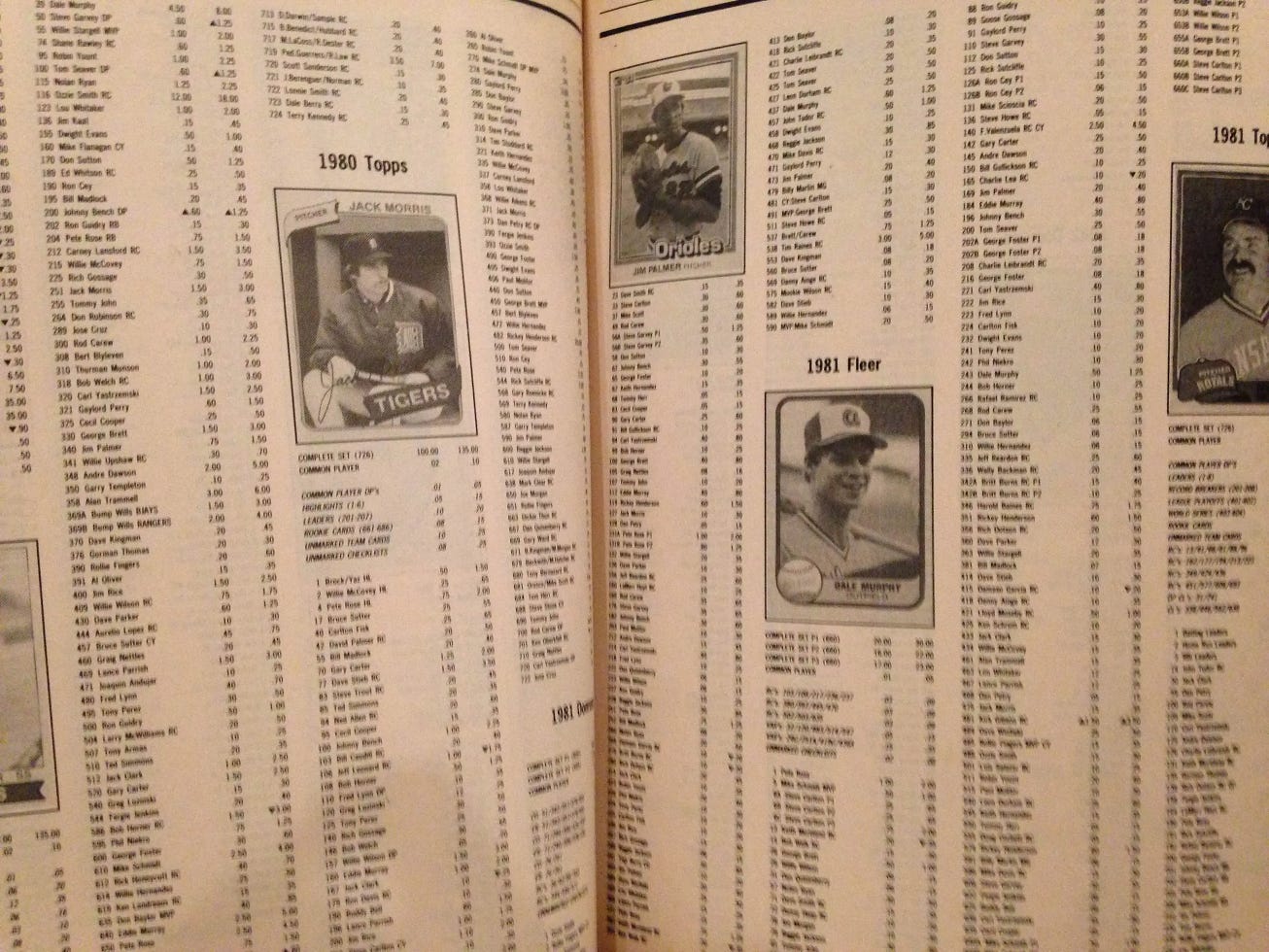

Things took another level of severity when I proceeded to discover basketball cards. The price tracking on monthly Beckett magazines turned this into a serious hobby, or one might even say an addiction. I’m sure the gambling aspect and dopamine hits opening randomized packs must have played a part in making it so fun, but the thought of owning a piece of basketball history and have it be an investment rather than a blackhole money sink was undeniably appealing. To their credit, companies like Topps did a great job sprinkling elements like bits of game-worn jerseys and pieces of hardwood into the rarest cards to validate those feelings.

Not knowing at the time that it all was all probably very negative EV, I went hard on those basketball cards, getting boxes of the Topps Finest collection and spending exuberant amounts on SPX packs that sold single holographic cards for nearly 10$ - my entire pocket money for the week. I wasn’t the most tidy of kids but you can bet I had my Topps Finest Kobe Bryant rookie card safely stored and secured like I had been through a rigorous Marie Kondo bootcamp. Regardless of the displeasure of my parents who have had to stock them and move them from house to house over the years, I still own them all to this day. To be fair I would love to unburden myself from that dust-collecting giant pile of cards but the effort would hardly justify the benefit.

I guess it was a logical evolution that basketball cards eventually turned into Marvel Overpower cards, which were collectibles with rarity but also came with utility inside a game. Problem was by that point my brother had gone off to university and I had no one to play with. It seemed like an insurmountable problem, that is until the Magic The Gathering Online (MTGO) busted onto the scene.

MTGO & The Birth of the Digital Collectible Revolution

My first exposure to MTGO was around the summer of 2003 or so when I could hear my brother raging at his computer repeatedly in frustration. “Ooh this must be interesting” I thought. He was playing some reanimator deck and burying cool creatures into his graveyard to then cheat them back into play way earlier than they would normally be playable. Cards like Butcher Orgg and Visara the Dreadful still linger in my memory as very badass characters that come more to life than the artwork alone could ever muster because of what they were able to do inside the game. Super nerdy stuff but as a kid who grew up on anime, video games, and collectibles…this was my jam.

The whole MTGO experience was conveniently self-contained. It was at least a 10x improvement from what was previously possible and probably as big of a leap from telegraphs -> telephones from the standpoint of the multiplayer Trading Card Game space. Those who lived outside the US and without easy access to hobby shops where the game was played with physical cards probably realized the value brought on by MTGO much earlier.

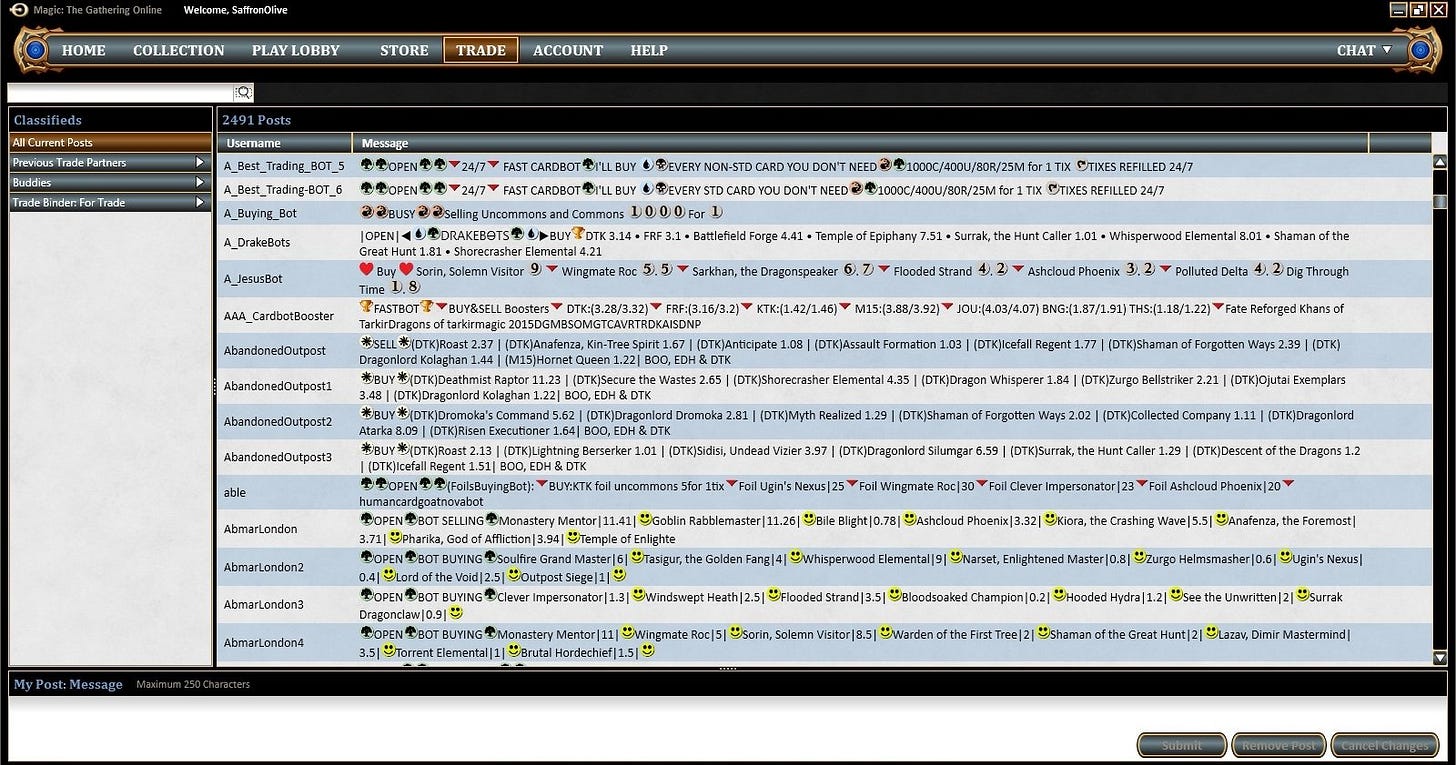

Magic The Gathering Online is probably one of the most ridiculed pieces of software in history and a whole documentary could be made on its many failures. But it was absolutely groundbreaking nevertheless. For the first time, there was a digital card-game with a real economy taking place live online - 24/7 - which anyone in the world could access. You didn’t need to stock or safeguard cards, have them appraised or shipped, find a buyer/seller on eBay, and hope you didn’t ultimately get scammed.

My distant cousins created the first trading bots for it whereby anyone looking to buy or sell cards had instant liquidity and they would just get a margin off the buy/sell spread. I imagine that the MTGO management or devs didn’t expect a simple message board where people could inconspicuously ask to engage in trades for specific cards to turn into a full-blown marketplace with immediate liquidity for any card or booster pack one could want. Unsurprisingly, it didn’t take long for the client to be flooded with tons of competing bots and even services that let you set up your own bot. This aspect of MTGO whether intentional or not had its cat out of the bag moment and it would be impossible to ever go back.

If you ever spent time setting up your own bot on MTGO, it would have been hard for you - even back in 2003 - to doubt the value of digital collectibles and the real economies that can be built around them. Without getting too deep into it, the economy revolves around limited players (a mode where you open packs and draft cards from them and build a deck on the fly) who try to go “infinite” by competing in draft tournaments and winning prizes, selling the good opened cards to fund another tournament entry + pocketing some cards for their collection ‘for free’. The buyers were the constructed players who want the best chase cards in new sets in order to make the best meta decks to compete with. So your job as a bot operator was to acquire the chase cards for cheap from limited players and sell them to constructed players for a margin. Serving as a middleman to provide liquidity and convenience for both buyers and sellers "wasn’t much but it was honest work", as DeFi yield farmers also proclaimed decades later. Waking up every morning and seeing the trade screenshots the bot had made with real people was a joy that was hard to rival for any kid who, for their entire childhood, had been reminded at every opportunity what a gigantic time and money sink video games were.

People who wanted to start such “businesses” or simply wanted in-game funds to buy cards or packs needed in-game currency, called Tickets. You could cash out your Tickets for “real money” via PayPal or bank wire using different third party sites, which used the same middleman concept to pocket the spread between buyer and seller. Unlike some of the games that came before it where real money trading (RMT) was actively hunted and shut down by devs, parent company Hasbro / WotC instead took a hands-off approach which allowed legit businesses to form and a culture of digital gaming assets to take hold on the internet.

MMO Gold Farming – The Ugly Side of Digital Collectibles

I don’t have extensive knowledge of the early MMOs like Everquest, Ultima Online, Eve Online and Runescape but gold farming and the existence of real money trades were certainly big parts of those games as well. If you talk around in crypto spheres you’ll come to realize that many of the successful early folks got their feet wet by trading and understanding market dynamics within those environments. Second Life is probably an even better case study but that deserves its own separate post one day as the first legit incarnation of the metaverse.

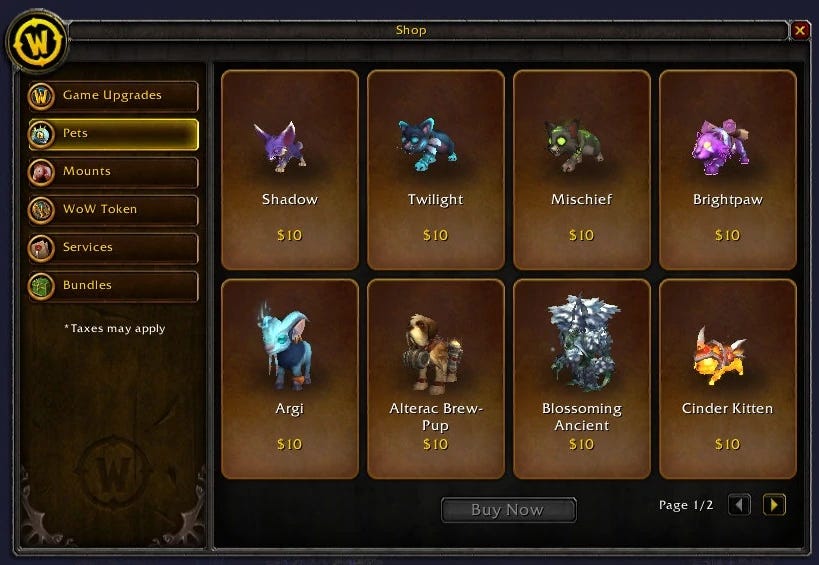

The MMO that got me and a lot of people hooked at the time though was a game developed by Blizzard called World of Warcraft (a mainstream success that still to this day has not been matched). I played WoW on launch in 2004 and for a number of years after, and unlike a game like MTGO, the digital economy was never a real part of the game. Instead, this aspect was intentionally buried into gray/black market status and any infringers were either suspended or banned. Gold farmers whether bots or real people in third world sweat shops, were widely regarded as evil and something that needed to be eradicated at all cost.

Those memories of having your grind spot camped by a Chinese hunter bot probably still plays a deep part in mainstream gamers’ disdain of digital collectibles (and by extension NFTs) and the perils of what might happen when you merge real money with gaming. In their defense, they were right – under the type of game and environment Blizzard created for WoW, digital assets were not something that made sense. Progression / achievement was primarily measured by soulbound / bind on pickup items that were earned through actual high-end gameplay and using your wallet to get ahead of others was regarded with disgust. Gold couldn’t actually buy you direct end-game progress but there were sites even offering power-leveling services as well as raid runs for the best items in the game. For the truly desperate, the murky and risky world of account selling was a possibility as well.

My closest friend in the game actually cracked one day and went to the darkside buying in-game gold with real money through one of the dodgy sites that were around at the time. I couldn’t resist the temptation and join him, as we kept our taboo gold-buying habits a secret from our guildmates. At first we felt like gods walking around with Krol Blades (one of the few epic items that were tradeable and thus purchasable with money). The thrill didn’t last however and we spiraled further down the dark path buying our way to the most stacked level 19 twinks we could possibly make. Twinks are low level characters that are on Soviet grade steroids in terms of itemization and can one shot regular opposing players in the low level PvP brackets. And I’m not going to lie: it was some of the most fun we had with the game albeit for a brief while (and explains why today’s mobile gaming industry and its widely adopted pay-to-win mechanics is a gigantic money printer). However that too got old and just like if you ever played a progression-based game with cheat codes activated - we just couldn’t go back to ‘normal’. The game from that point on had lost its luster.

The MMO gold selling debacle demonstrates that not in every game do digital assets/collectibles make sense, but it would be wrong to conclude - as many have using this as their only experience - that it doesn’t make sense in ANY context. Blizzard has been going in a troubling direction in this regard: selling items for real money (large sums at that) but not offering purchasers any advantages that something like NFTs offer.

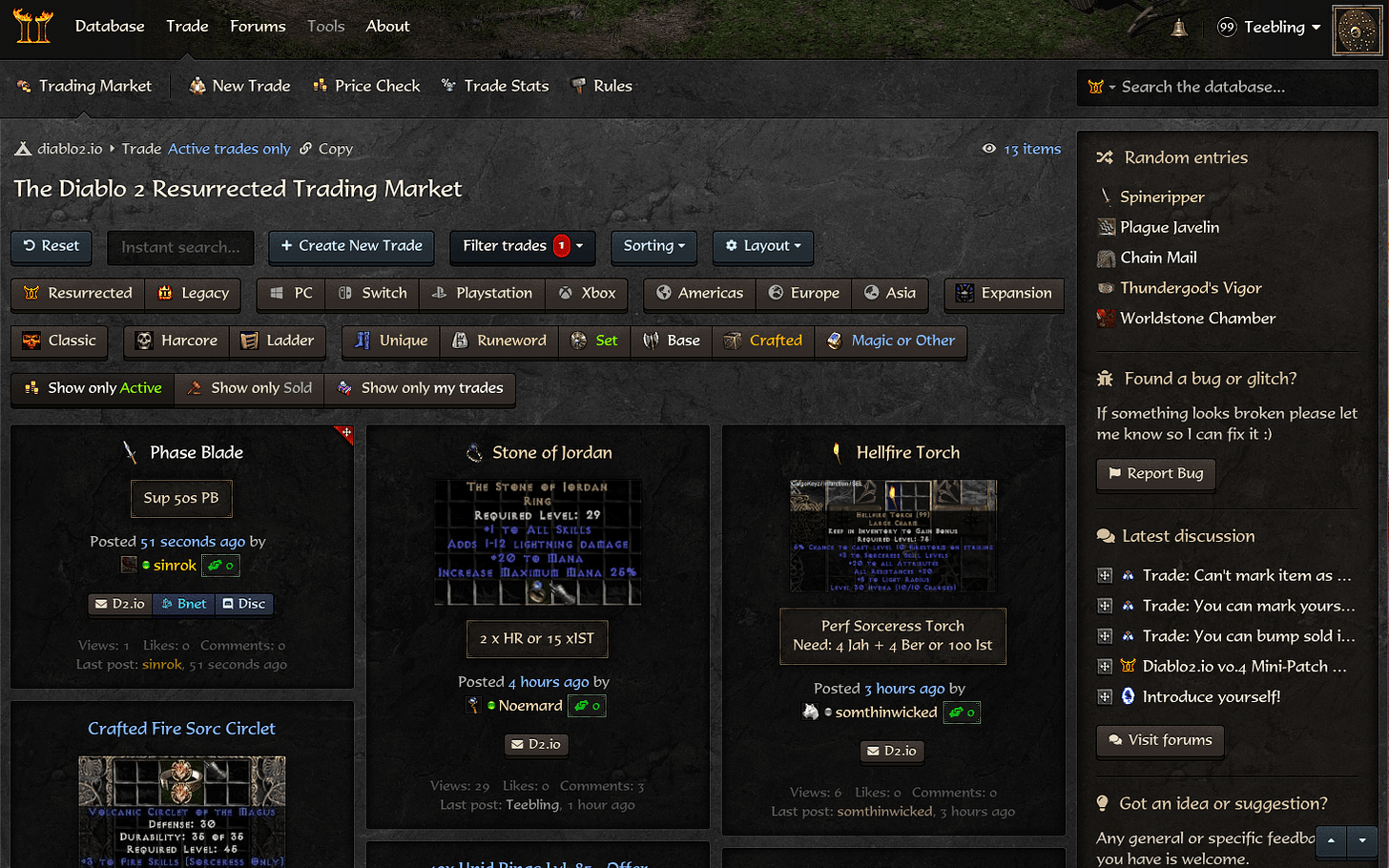

Diablo 3 Real Money Auction House: An Unfortunate Fork In the Road

Besides being a huge Diablo fan, the release of Diablo 3 in 2012 had special importance for me because for the first time, a major industry leader was not only allowing real money trading in their game but embracing it and making it a core part of it. Diablo 2 had a pretty active underground / grey market real money trading scene (with tons of drama around dupe bugs and whatnot) but this was going to be completely legit, without the anxiety of constantly looking over your shoulder and fearing an account ban or a scam!

Unfortunately it became the biggest train crash and disappointment imaginable. Anyone who followed the early days of Diablo 3 knows what a mess the end game balance and design were. After completing the normal storyline in under 24 hours, you were essentially launched into the loot grind with an array of problems: from difficulty being way over-tuned (the infamous we ‘doubled it’ phrase), to the dropped loot often not matching your class or build, to D3’s inherent random stat system that lowered the chance even further of you personally rolling the exact item that you needed.

This resulted in people forcefully having to use the auction house to get any sort of progression to speak of. It was terrible design and game-breakingly bad planning. D3 had gone through several late adjustments to their systems so that part seemed clearly rushed, and the game had already been delayed for too many years to do so any further. To this day, the ‘RMAH’ still takes the blunt of the blame for the game’s initial failure despite it just being a lazy available solution to a problem that shouldn’t have existed to the degree it did in the first place. The optics of players having to play the auction house, or even worse having to get out their credit cards, in order to be able to progress at all was not something that people could easily shake off.

Given the player outrage and Diablo never being a franchise that received much after-release support, they went with the easy solution of removing the real money auction house as well as the gold auction house altogether rather than trying to rework it in a way that could have made sense. No major game developer has since attempted such a thing again and the digital game asset movement had been dealt what seemed like a fatal blow.

Hex TCG: An NFT Game Before NFTs

In 2013 one of the biggest video game fund raises in Kickstarter history took plac with a game called Hex: Shards of Fate. It had grand plans around being the logical evolution of MTG that would have a much prettier client but also big MMO/RPG features. It was fully digital, founders seemed super cool and were okay with people doing real money trading - the sky was the limit. AAA game studios might have been turned off from the idea of real-money assets, but perhaps an innovative indie title could make it work.

Many scoffed at the idea of buying digital-only cards for real money at the time, as the CCG boom that Hearthstone brought on had yet to happen. Personally, I actually saw it as an advantage seeing as previous physical collectibles I owned had either been lost or had become a burden to maintain. I was all-in to the idea and concept so I instantly jumped in headfirst.

My brother and I ended up pouring much of our limited savings into the game and bought up cards and very attractive KS lifetime perks in order to create what would end up becoming the first digital-only collectible card e-commerce store in existence. In a way, it made no sense because not only was the premise of people spending huge amounts on digital-only cards largely unproven, but there was already an auction house built right into the game client itself to facilitate p2p trading. I don’t know if we were too naïve or too hungry to be involved, but we decided to go for it anyways and built a shop on top of Wordpress / WooCommerce with every tradable asset in the game which people could buy via PayPal or Bitcoin.

Our announcement of the shop in the game’s subreddit was met with absolute bewilderment as no one understood the value proposition or why we existed. It probably didn’t help that our prices were slightly above that of the Auction House either. For the first week, we only had a few sales and seriously considered whether we had completely missed the mark and blown our savings on digital cardboard “assets” that couldn’t even serve as emergency toilet paper. Through a ton of hustle and innovative additions to the site however, we slowly started to build a customer base that appreciated the extra speed and convenience we offered compared to the in-game AH. We brought on pro players to write strategy articles and guides, hired devs to make QoL tools such as importing decklists straight to the checkout cart, hosted officially sponsored and casted real money prize tournaments (with in-game branding) on Twitch, held regular giveaways and loyalty programs, etc. I won’t bore you with the details, but this was our actual full time job for a few years and we poured everything into making it THE authority site/brand.

Probably the craziest part of the whole thing is that since bots were not allowed, we delivered every single order by hand - oh how we wish something like smart contracts existed back then. We took shifts and had mobile alerts go off when we would get an order email and would then log-on the account and send the cards through the game’s mailing system ONE BY ONE, which sometimes took half an hour of clicking hundreds of cards. We were also young and stupid and promised delivery under 30 minutes or a gift for compensation - not quite as stupid as the Bitcoin pizza guy but as far as pizza themed stunts go, pretty close.

In the end, it was all kinda crazy but it worked. We grew it to a six-figure business and it might have been one of the first legit fully digital asset shops to ever exist on this scale. Yesss I thought, against all odds, my lifelong childish hobby of collectibles had grown into a lifechanging revenue source and business… That is until a few years in when the game struggled with development and fell behind rising star Hearthstone, got sued by Magic the Gathering, ran out of resources, and ultimately shut down in 2020. I could probably write a book’s worth of interesting lessons from that time but ultimately I believe that the game and business model was slightly ahead of its time and would have been ideal in the current blockchain / NFT environment. Besides, the trend at the time was clearly shifting in the direction of free-to-play games and monetization through the sale of cosmetic changes called ‘skins’. And boy what a huge market that would end up being.

CS:GO & The Skin Market Explosion: And Why NFTs Are A Must

The past decade or so has seen a big shift away from giant too-expensive-to-produce immersive MMOs to quick competitive games (especially MOBAs & FPS) promoted by eSports coverage and streamer personalities. It also saw games with collectible elements shift to closed economies due to the rise of the free-to-play movement (especially on mobile) where game producers realized they could grow their game way faster making it free, and end up charging their engaged players way more by removing trading and adding random gambling / gacha elements. As a true believer in long-lasting digital assets with real utility you can own, use, and trade as you like, this was neither the direction that I believed in nor something I was interested to participate in. I had also just experienced a giant sum of digital inventory go worthless when the Hex TCG servers shut down, so safe to say I needed a break.

But the industry didn’t stop, to the contrary there was a Cambrian explosion in terms of changes to the space as I sat as an outsider observing the fascinating growth of skins, DLC, microtransactions, lootboxes, F2P, mobile gaming, game modding, Twitch streaming, and eSports. All these concepts emerged in a relatively short amount of time and were pretty intertwined - they combined to change the business of video games forever. For our purposes here, the game that best captured all of these concepts in one neat package best was Counter Strike: Global Offensive and their skin gambling phenomenon.

After seeing some success with their Team Fortress 2 skins, Valve really hit it big when they introduced weapon skins to their game CS:GO in 2013. The original idea was to unify the scattered Counterstrike players into this one new game they had launched a year ago and also attract new players who could earn these skins for free and in turn flip them on Valve’s own Steam Marketplace. The player count shot up tremendously and the knife / gun skins were a hit beyond anyone’s wildest imagination.

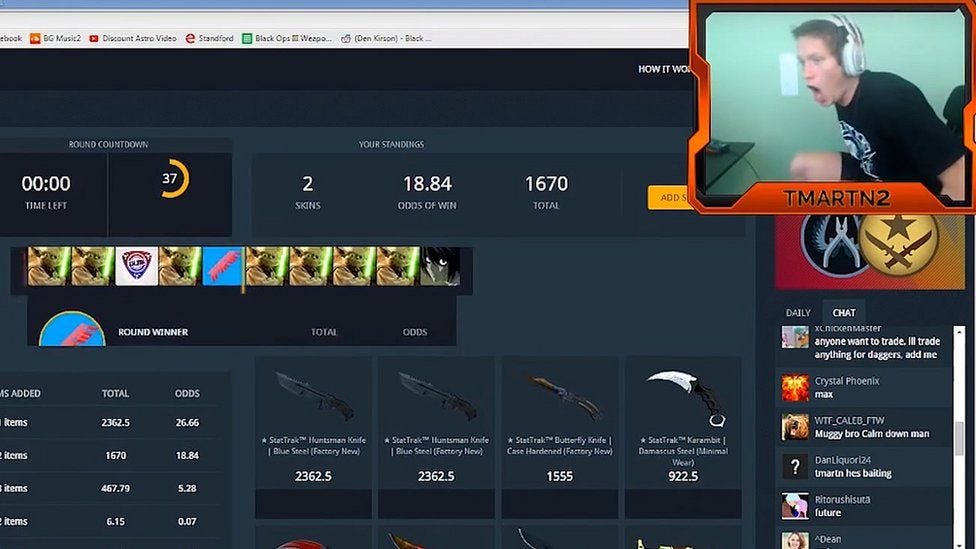

But the real mania occurred due to Valve’s open API whereby third party sites could take these skins and have people use them in different ways. Betting sites that leveraged the growing CS:GO eSports and streaming scene, pure casino type gambling sites that circumvented gambling laws by using the skins as a form of currency, and just good ol’ marketplaces where flippers would spend more time speculating and buying & selling skins than actually playing the game. It was exactly like the open composable nature of NFTs but there was of course a big difference: it was completely dependant on Valve’s centralized Steam Marketplace and API access.

Third party sites having access to build products / services / experiences on top of these digital assets through the API was obviously a huge positive, but like we’ve seen countless times in crypto they also opened the door for nefarious actors. There was also a ton of drama from underage gambling, to YouTubers scamming their audience with undisclosed affiliations, to match throwing on the eSports scene, to dodgy third party sites in sketchy jurisdictions and everything else in between.

In 2016 after all the different scandals had mounted up and lawsuits were starting to propagate, there was simply too much pressure for Valve to sit by and do nothing. In July of that year they sent a cease and desist letter to dozens of gambling sites. They trade-banned thousands of accounts and thus wiped millions of $ worth of assets in a single go. While some sites shut down, others ignored and circumvented the threats by opening endless new bot accounts (which helped serve as a middleman escrow account between a buyer and a seller). In September, Valve received a letter from the Washington Gambling Commission ordering them to cease facilitating gambling through the Steam platform which Valve replied essentially saying they weren’t breaking any laws and weren’t responsible for the behaviors of these third party sites. From Valve’s point-of-view, they had done what they could whilst leaving open their API which was crucial for many other legitimate purposes. Regulators and lawsuit plaintiffs (some of which included disgruntled parents checking their credit card bill) had nothing to pin Valve itself on, and many thought the peak of the drama might be over.

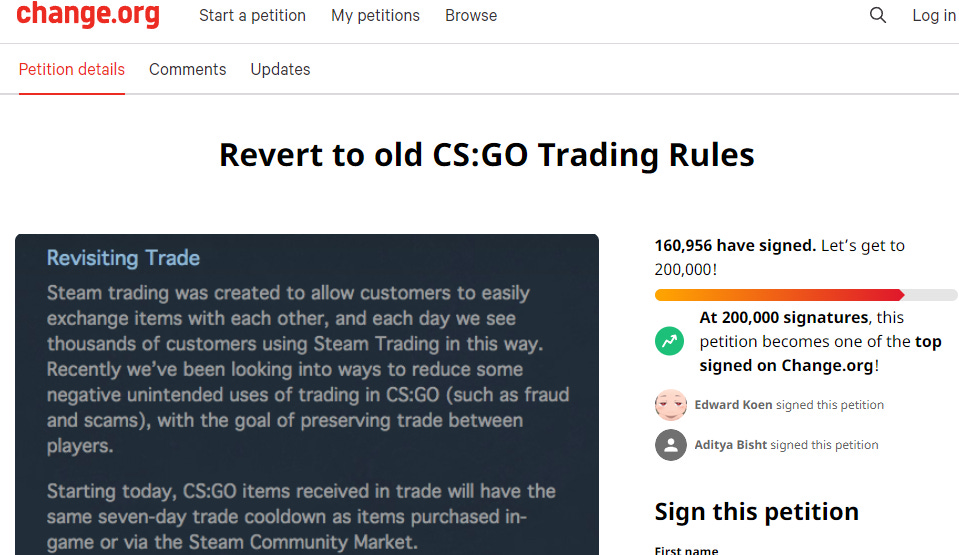

For a few years things muddled along with shady controversies that came and went but perhaps sick of realizing things weren’t just going to go away, Valve in March of 2018 introduced a seven day trade cooldown on CS:GO items that would shake up the skins trading world. Along with another big wave of account bans, this seemed like it would stop skin gambling in its tracks. There was a big push by the community to reinstate old trading rules (as much as 160k people signed one such petition) but the response by Valve was negative, citing a 70% reduction in scam related support tickets and that things were working as intended.

We’re approaching perhaps the most interesting part from a digital asset perspective, when on June 6th 2018 OPskins (the largest cashout site for skins) introduced a feature that would bypass the trade cooldown called “express trade” which other sites tapped into as well. It only took two days for Valve to strike back in a decisive way, sending a cease order for violating the Steam’s Subscriber agreement and threatening to shut down their accounts.

After a public outburst against Valve, OPskins and other stubborn skin-related gambling sites would be forced to change course first creating VGO skins (which are weapon skins with no utility inside a game) and then vIRL (digital items meant to have physical counterparts with value, like rare sneakers). Both those concepts flopped pretty hard. It would be something called p2p trading that would ultimately result in a sustainable method by which trading of skin assets for real money would find its desired conclusion. Instead of relying on middleman bot accounts that hold assets in escrow, players instead send items to each other directly and p2p marketplace sites handle the rest. Buyers are matched with sellers as the site guides all parties about how to execute and finalize the trade, all happening outside the control of the central ‘authority’ that is Valve.

There could have been a great opportunity turning these skins and crates into NFTs with smart contracts bypassing the middleman sites and even providing a revenue source back to Valve for such trades. Instead, Valve chose to close the door on any such idea quite firmly in October of 2021 when it banned blockchain games and NFTs all together on Steam.

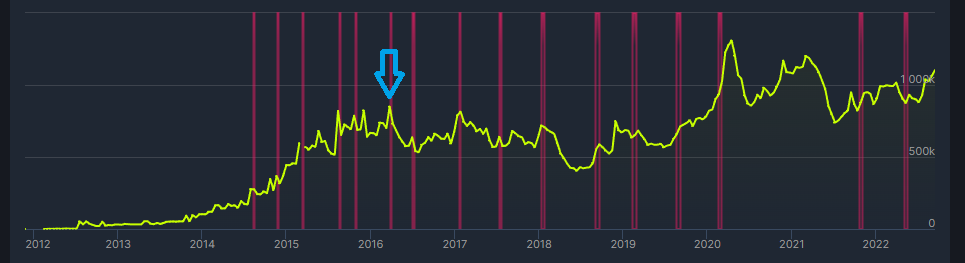

If you look at the player count stats, you can see that number of players peaked right around the trading cooldown decision in 2016 and stagnated until the pandemic in 2020 when a new wave of interest thankfully arrived.

Today, the CS:GO skin market is still alive and well, with dozens of rare collections holding over a thousand unique skin patterns, with the market capitalization of all weapons estimated to be over a billion dollars. The rarest skins have fetched 6 figures and the 7 figure territory doesn't seem too far off.

There are many lessons to take away from the CS:GO saga, but to those paying attention it made one thing abundantly clear: when you own assets or operate a business within a framework where one central party has all the control, you are at risk of being completely wiped away without warning in a matter of seconds. If this was to be the future of gaming where players finally have a way to see returns for all their in-game efforts, as Valve CEO Gabe Newell himself at one point believed should be the case, there just had to be a better way...

Enter Blockchain & NFTs

Judging from my history and belief in digital assets, you could probably tell that I managed to get into Bitcoin rather early - buying my first Bitcoins in 2013 and operating businesses that accepted it whilst it was still in its ‘p2p cash’ phase. Unfortunately, an abrupt exchange shutdown saw most of my wealth in cryptos disappear, leading to my exodus from the scene until 2017, when my eyes lit up at the discovery of Ethereum. Not only was it not one of these countless ‘alts’ that were lazy forks of Bitcoin, but something that would end up changing the world by underpinning the evolution of digital collectibles and unique assets into what will probably be their final form: NFTs.

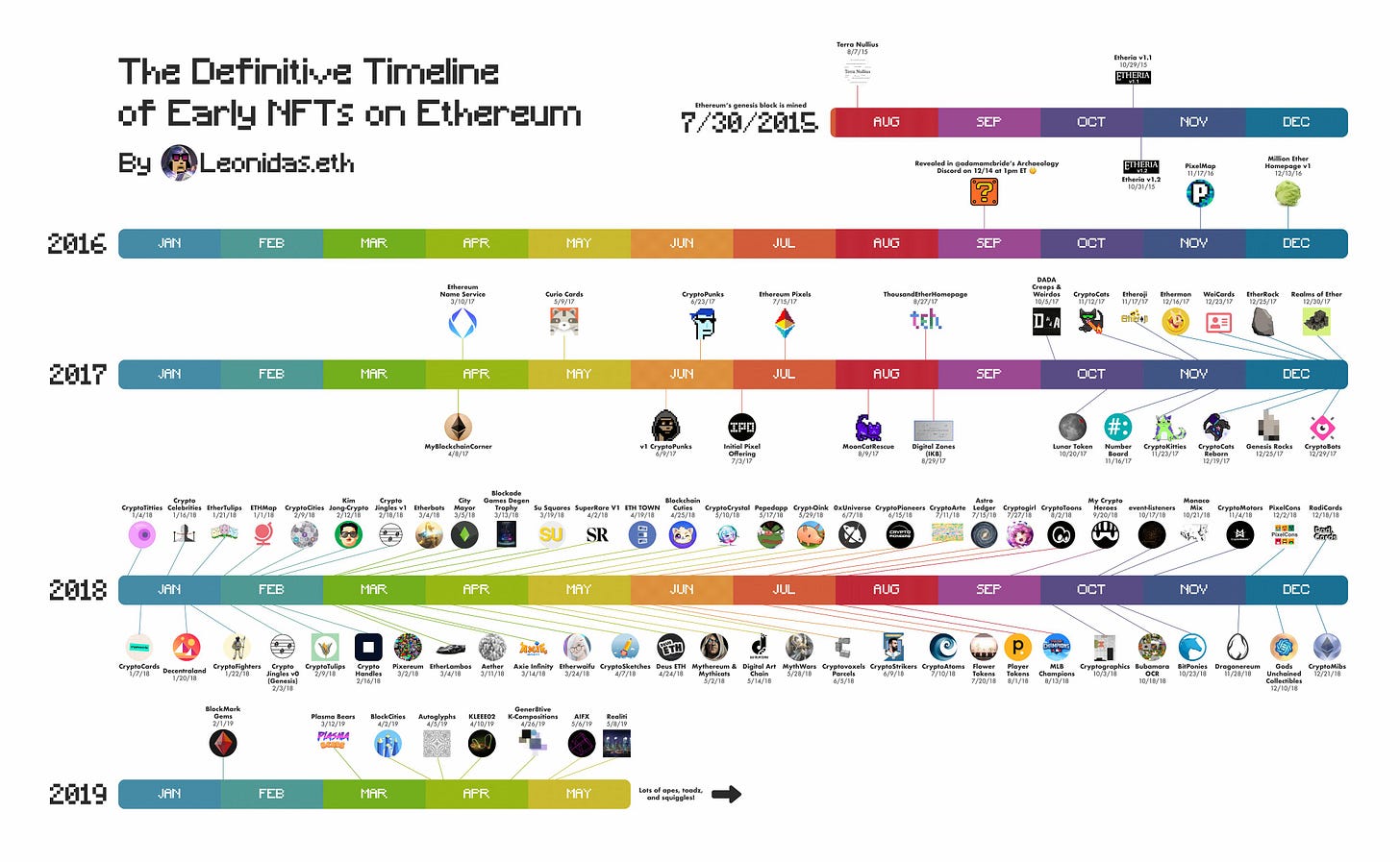

The story from this point forward has been told many times over: from the rise of Cryptokitties and how it broke Ethereum, to the free to mint inconspicuous Cryptopunks, to Artblocks and the generative art phenomenon, to Beeple and artists finally getting PAID, and most recently to the trio of NBA Top Shot, Bored Ape Yacht Club and Axie Infinity showing the world a small glimpse of the boundless possibilities the space has to offer.

Reading the different key moments in digital collectible history I've shared above, one can easily notice the numerous strengths and opportunities that are present with NFTs and how they have the potential for so much improvement over the status quo:

-Those missing Panini stickers I can now trade for, I can see odds for, I can see total supply and history of ownership of. Max transparency.

-My basketball cards are now Top Shot Moments that stay in pristine quality and that I can dump at a moment’s notice. No logistical or maintenance nightmares. Max liquidity.

-Games and MMOs being built with careful and sustainable economic consideration that will enhance game immersion and excitement as opposed to take away from them. Perhaps an MMO experience will rise and after 20 years will give peak WoW a run for its money in terms of excitement and hype. Max stakes & immersion potential.

-The MTG bot, HexTCG eCommerce store, CS:GO p2p marketplace type middleman businesses mentioned replaced by much more sophisticated, programmable, trustless, and efficient marketplaces and smart contracts. Allowing anyone around the world to have trading-related businesses or even to just trade native assets on an open ledger without worrying about ToS or servers shutting down. Max openness.

-Not having a large chunk of your net worth or the fate of your business being decided by the whims of a single corporation like Valve and what it deems to be right and wrong way to use what is still THEIR assets. Max ownership.

Is it perfect? As with any new technology that is still in its infancy: of course not. I will address all the often misunderstood or overstated criticisms about NFTs in a future post, but I am certainly convinced that it’s the next best thing we've got in the evolution of collectibles. If it wasn’t, I would continue to move on to whatever ‘that’ is. This isn’t about being at the top of a pyramid scheme or shilling your bags for the many people still left in the industry today. There are many people today who trust Valve/Steam more than smart contracts, but these people either aren’t thinking on a long enough timeline or haven’t studied the history of relying exclusively on centralized parties (however reliable they might seem today).

This is about finally having a globally agreed upon standard and open platform by which people can own and trade digital collectible assets and plug into any composable dApp that one could imagine - all in permissionless fashion. This allows for a common ground to be established where likeminded individuals / creators / businesses can build on top of a neutral decentralized open platform without worrying about various power struggles or politics.

You don’t have to look too far back to appreciate how far we have come, just as you don’t need to peek too much into the future to see how much further we can go.

In this newsletter, I hope to embark on this adventure along with you all, as I roam the metaverse in search for evergreen collectible grails and explore all the possibilities as we unlock this layer of value from the internet, gaming and culture as a whole.